Aspire to attaining Sustainability? Let’s understand contemporary Sustainability or

ESG Frameworks

Authors: Dr Kuntal Goswami Dr Mdh Kazi Islam, Winton Evers

The Blue Planet-A Magazine on Sustainability

ISSN: 2652-7987 (Online) ISSN: 2652-7995 (Print)

Article: 2 Issue: 4 Volume: 1 2022

Photography by

Vijay Mandave

Aspire to attain Sustainability? Let us understand contemporary Sustainability or ESG Frameworks.

Authors: Dr. Kuntal Goswami, Dr. Mdh Kazi Islam, Winton Evers

If an organization aspires to attain Sustainability, it is vital to understand the fundamental perspective of contemporary ESG Frameworks or Sustainability Reporting Standards. The five most prominent contemporary ESG frameworks or Sustainability Reporting Standards have been promulgated by The Global Reporting Initiatives (GRI), International Integrated Reporting Council (IIRC) or Integrated Reporting (IR.), Sustainability Accounting Standard Board (SASB), Climate Disclosure Project (CDP) and Climate Disclosure Standards Board (CDSB).

Key Words : ESG frameworks, Sustainability Reporting, The Global Reporting Initiatives (GRI), International Integrated Reporting Council (IIRC) or Integrated Reporting (IR.), Sustainability Accounting Standard Board (SASB), Climate Disclosure Project (CDP) and Climate Disclosure Standards Board (CDSB), Sustainable Development Goals, Triple bottom line.

Video coming soon

In 1972, Barbara Word and Dubos Rene coined the term Sustainable Development. In 1994, John Elkington put forward the phrase “triple bottom line” to describe the concept of Sustainability. Sustainable Development or Sustainability concepts have travelled a long way since they were coined. Today, many communities are cities. Governments and organizations are aspiring to follow the path of sustainable development. Sustainability has become an essential strategic policy agenda for public and private sector organizations.

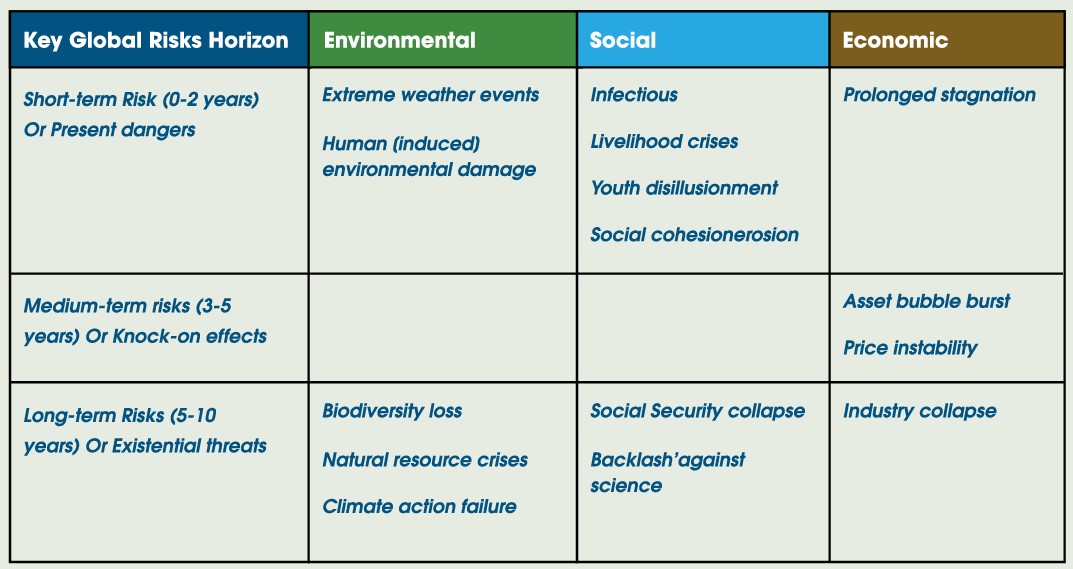

Even though the sustainability agenda is acknowledged as necessary, we must urgently address specific issues that tipping our planet’s ecological balance. According to The Global Risks Report 2021, we face many risks over time. Some of the most critical environmental, social, and economic risks are listed in Table 1. The topmost “Likelihood” and most “impactful” risks are as follows:

∅ Extreme weather. Climate action failure. Human (induced) environmental damage. Infectious diseases Biodiversity loss. Digital power concentration, Digital inequality, Interstate relationship fracture, Cybersecurity failure, and Livelihood crises are the topmost “Likelihood” global risks.

∅ Infectious diseases, Climate action failure, Weapons of mass destruction. Bio-diversity loss. Natural resource crises, Human (induced) environmental damage, Livelihood crises, and Extreme weather. Debt crises and IT Infrastructure breakdown are the topmost “Impactful” global risks.

Table-1 Global Risk Exposure

Over the years, there has been growing stakeholder pressure on the top management of companies to look beyond financial performance alone.

Organizations must excel in all three dimensions of sustainability performance (environmental, social, and economic). Against the backdrop of the above-mentioned global risk factors and as economies are emerging from the shock of COVID-19- 19, the chorus is growing loud to embrace the sustainable development model and integrate sustainability perspectives within organizational strategic policy.

Adopting Sustainability is increasingly seen as a responsible business practice and a fiduciary duty of business leaders. Most importantly. Operating within the holistic sustainability criteria is a prudent business decision to reduce negative socio-ecological impacts and mitigate risk exposure.

Sustainability practices: from a Voluntary to a Mandatory regime

After prolonged intellectual debate and activism by various stakeholders, Sustainability is an influential policy agenda within the statutory and regulatory frameworks.

Today, Sustainability is no longer a voluntary disclosure obligation in many jurisdictions as organizations are mandated to disclose the positive or negative impacts of their operation’s environmental, social, and economic impacts. In addition, stakeholders, including investors, are interested in knowing about an organization’s risk exposure from a holistic sustainability perspective.

About 45 countries across the globe have enacted about 140 laws and regulatory standards that mandate companies to disclose some aspect of a company’s sustainability performance. For example, the Czech Republic updated its accounting law in 2017 and prescribed that all large entities with more than 500 employees must report on their non-financial performance. In 2017, France transposed its ‘1180 Ordonnance’ based on the European NFRD into French law. In 2019, the Securities and Exchange Board of India (SEBI) instructed its top 1000 companies to publish Business Responsibility Reporting (BRR).

In 2017, Germany adopted the European NFRD and instructed all listed financial and non-financial companies with more than 500 employees to report on certain sustainability information. In 2018, Japan adopted TCFD recommendations and revised its Environmental Reporting Guidelines.

In 2018, Nigeria’s Securities and Exchange Commission (SEC) approved the Nigerian Stock Exchange’s Sustainability Disclosure guidelines. In 2018, Pakistan adopted the Sustainable Development Goals in its National Framework. In 2019, the UK introduced the Net Zero 2050 commitment in law and instructed UK’s listed companies to publish information based on TCFD recommendations from 2022. The Abu Dhabi Stock Exchange (ADX) has formally committed to incorporating sustainability aspects in the financial market in partnership with the United Nations-led initiative: The Sustainable Stock Exchange Initiative (SSE).

In addition, 15 stock exchanges have prescribed formal guidelines on sustainability reporting to their listed companies.

Contemporary Sustainability or ESG Frameworks

Many voluntary non-financial reporting frameworks and standards have evolved with a growing regulatory shift towards non-financial disclosures.

The five most prominent contemporary sustainability reporting or ESG frameworks and standards have been promulgated by:

∅ The Global Reporting Initiatives (GRI),

∅ International Integrated Reporting Council (IIRC) or Integrated Reporting (IR),

∅ Sustainability Accounting Standard Board (SASB),

∅ Climate Disclosure Project (CDP) and

∅ Climate Disclosure Standards Board (CDSB).

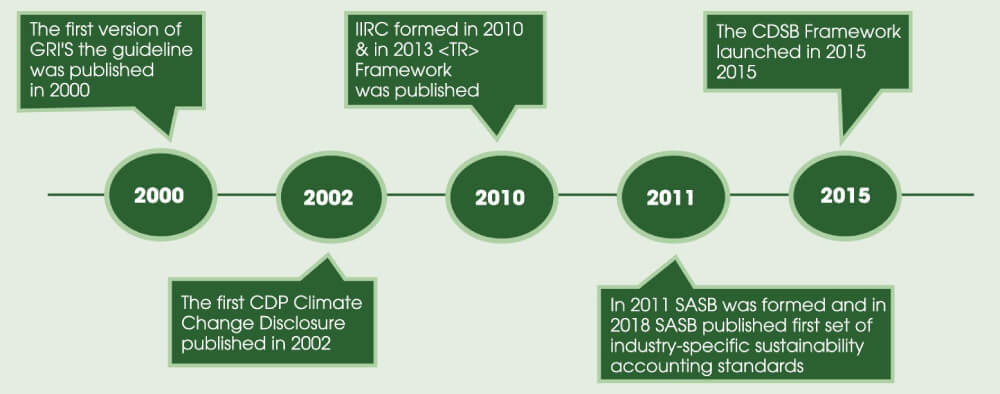

Figure 1: Timeline of Contemporary ESG Framework

Global Reporting Initiatives (GRI.)

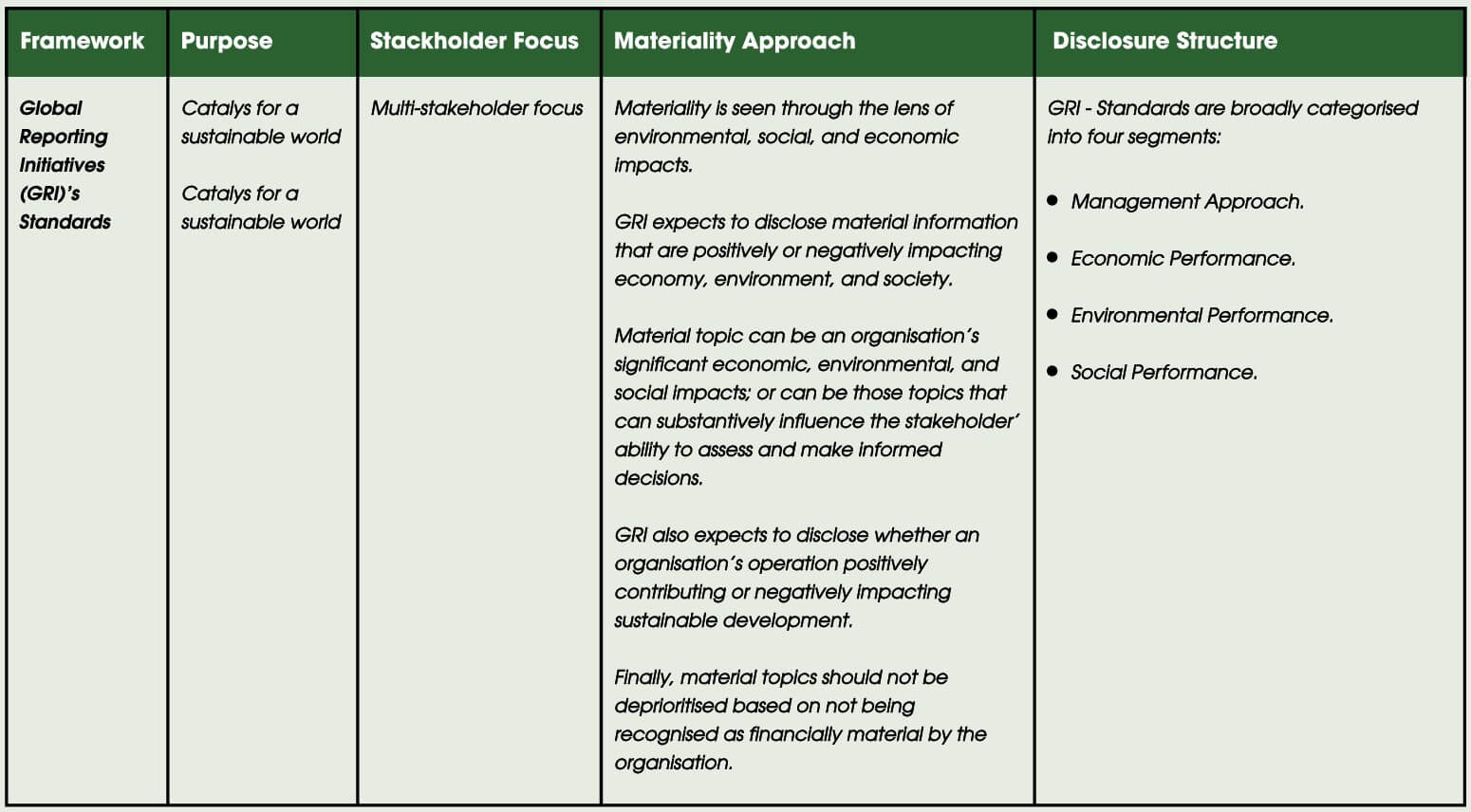

GRI provides multi-stakeholder-focused standards, and it has positioned itself as a catalyst for a sustainable world. The purpose of the standard is to support an organization’s and its stakeholders’ decision-making process about the organization’s economic, environmental, and social performance.

GRI’s sustainability topics include market presence, indirect economic impact, procurement practices, anti-corruption, anti-competitive behaviour, tax, material, energy, water, effluents, biodiversity, emission, waste, environmental assessment, employment, labour relation, OHS, training, diversity, equal opportunity, non-discrimination, freedom of association, child labour, forced labour, security practices, rights of indigenous people, human rights, local communities, supplier social assessment, public policy, customer health & safety, marketing & labelling, customer privacy, and socioeconomic compliance.

Table 2 An Overview of GRI Standards

GRI standards facilitate an organization to identify and report financial material positive or negative economic, environmental, mental, and social impacts of their operation on both the short- and long-term time horizons. As per GRI standards, an organization needs to identify material sustainability topics from two perspectives:

a) to identify those material sustainability topic areas of an organization’s operations that are positively or negatively impacted, as well as advancing or detrimental to sustainable development.

b) to disclose that information has the potential to influence stakeholders’ decision-making abilities and assessments significantly or substantively.

Most importantly, GRI strongly advocates that material sustainability topics should not be deprioritized based on not being recognized as financially material by the organization.

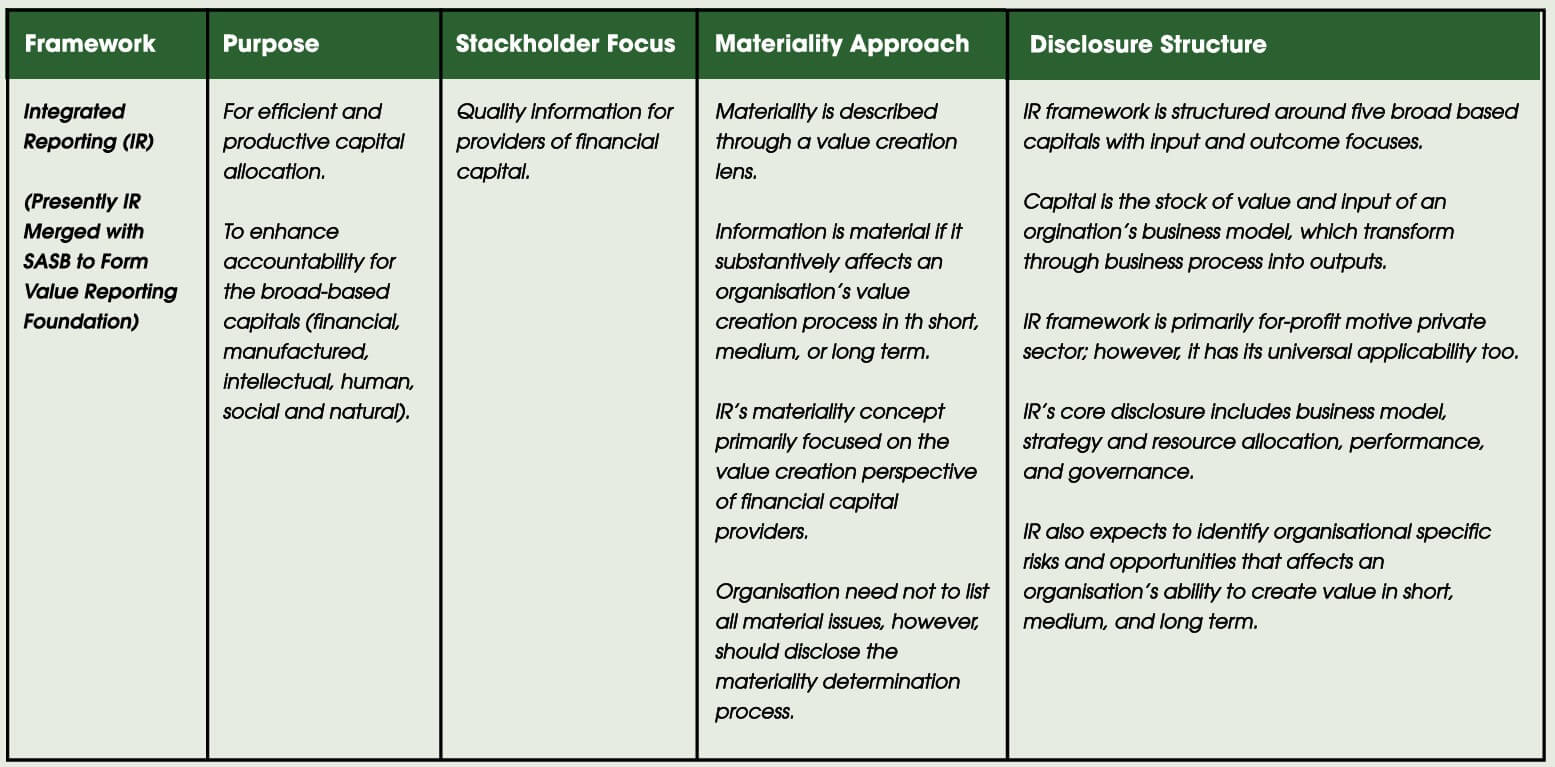

Integrated Reporting (IR)

The Prince’s Accounting for Sustainability Project (A4S) and the Global Reporting Initiative (GRI) formed the International Integrated Reporting Committee (IIRC) in 2010. Later, the committee was renamed The International Integrated Reporting Council (IIRC).

Integrated reporting is a principles-based framework founded on the concept of integrated thinking, which is a subset of systems thinking. The integrated reporting system informs financial capital providers about how businesses create value by efficiently utilizing five broad-based capitals (financial, manufactured, intellectual, human, social, and natural). Capital is the stock of value and input of an origination’s business model, which transforms through business activities into outputs. Hence, an Integrated Report defines material information through the prism of value creation.

As per IR., information is material if it substantively affects an organization’s value-creation process in the short, medium, and long term. The International Integrated Reporting Committee (IIRC) and the Sustainability Accounting Standard Board (SASB) have merged to form the Value Reporting Foundation.

Table 3 An Overview of Integrated Report

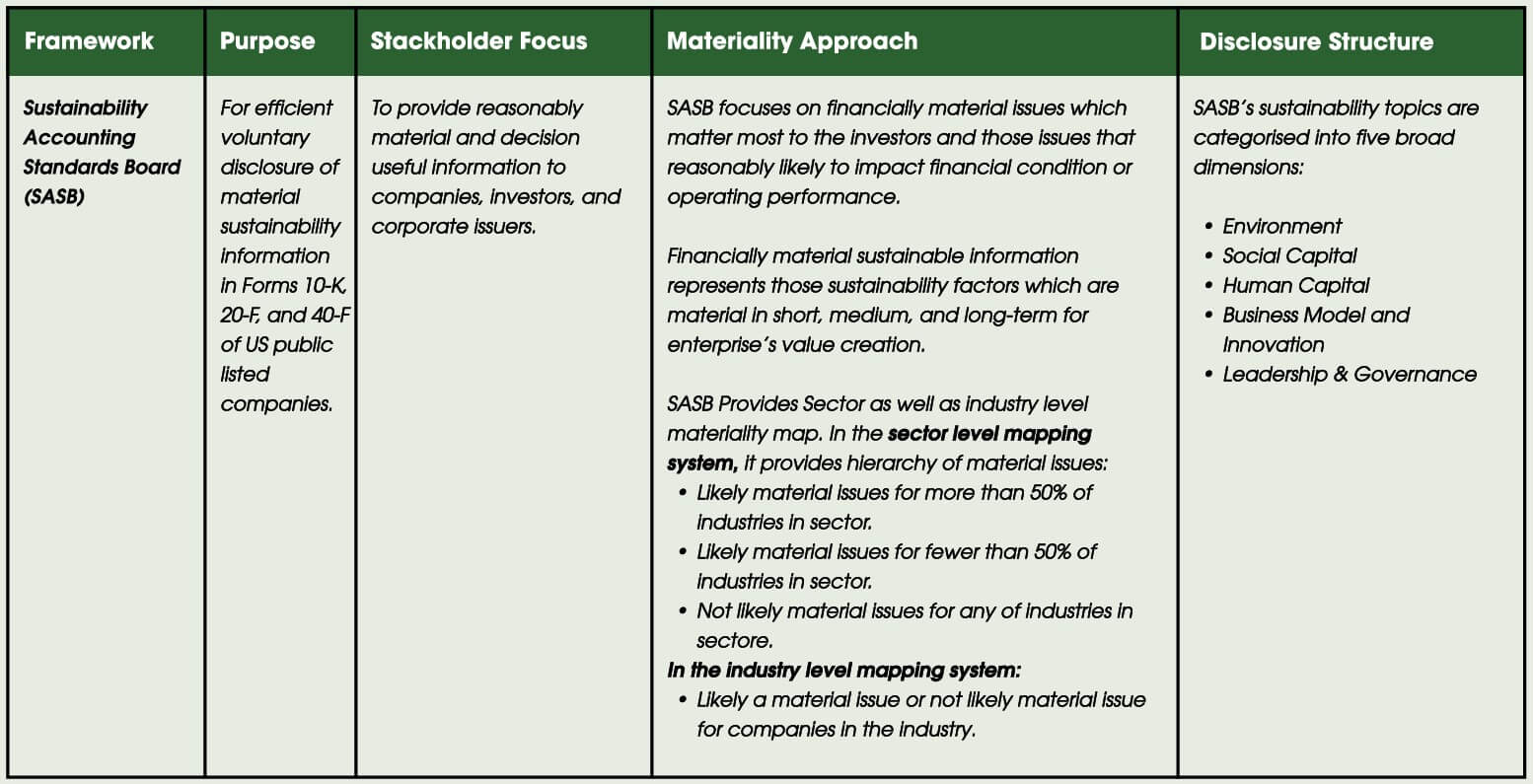

Sustainability Accounting Standard Board (SASB)

SASB was established in 2011 as a not-for-profit organization to develop sustainability accounting standards for investors, lenders, and businesses in the USA. SASB provides sector-specific metric-based voluntary reporting standards. It encompasses eleven sectors and seventy-seven industries.

These sectors are:

∅ Consumer goods (7 industries),

∅ Extractive and minerals Processing (8 industries),

∅ Financials (7 industries),

∅ Food and beverages (8 industries),

∅ Health Care (6 industries),

∅ Infrastructure (8 industries),

∅ Renewable Resources & Alternative Energy (6 industries),

∅ Resource Transformation (5 industries),

∅ Services (7 industries),

∅ Technology & Communications (6 industries),

∅ Transportation (9 industries).

SASB covers five broad topics: environment, social capital, human capital, business model and innovation, and leadership and governance.

SASB’s sector-specific sustainability topics include:

∅ GHG Emission

∅ Air quality

∅ Energy Management

∅ Water & Wastewater Management

∅ Waste & Hazardous Materials Management

∅ Ecological Impacts

∅ Human Rights & Community Relations

∅ Customer Privacy

∅ Data Security

∅ Access & Affordability

∅ Product Quality & Safety

∅ Customer Welfare

∅ Labor Practices

∅ Employee Health & Safety

∅ Selling Practices and product Labelling issues, alongside specific sustainability risks and opportunities

∅ Employee Engagement and Diversity Inclusion

∅ Product Design & Lifecycle Management

∅ Business Model Resilience

∅ Supply Chain Management

∅ Materials Sourcing & Efficiency

∅ Physical Impacts of Climate Change, Business Ethics

∅ Competitive Behaviour

∅ Management of the Legal & Regulatory Environment

∅ Critical Incident Risk Management and

∅ Systemic Risk Management

In the context of SASB, sustainability information is material if it is financially material and can impact an enterprise’s value-creation process in the short, medium, and long term. SASB also prescribes a sector and an industry-level materiality mapping tool. The materiality map helps corporations to strategize sustainability goals and provides the metrics to underpin disclosure topics. For an investor, the materiality map provides a tool to analyse an industry or sector issue alongside specific sustainability risks and opportunities.

Table 4 An overview of the Sustainability Accounting Standard Board (SASB)

The International Integrated Reporting Committee (IIRC) and the Sustainability Accounting Standard Board (SASB) have merged to form the Value Reporting Foundation. The merger of IR and SASB created a new synergy by combining two perspectives:

a) to formulate a strategy on how to utilize capital (environment, social capital, human capital, business model and innovation, and leadership and governance) to enhance and maintain the value of an organization over time the value of an organization over time horizon; and

b) to identify industry-specific financial material sustainability risks and opportunities that erode or enhance a company’s ability to create value for investors over time.

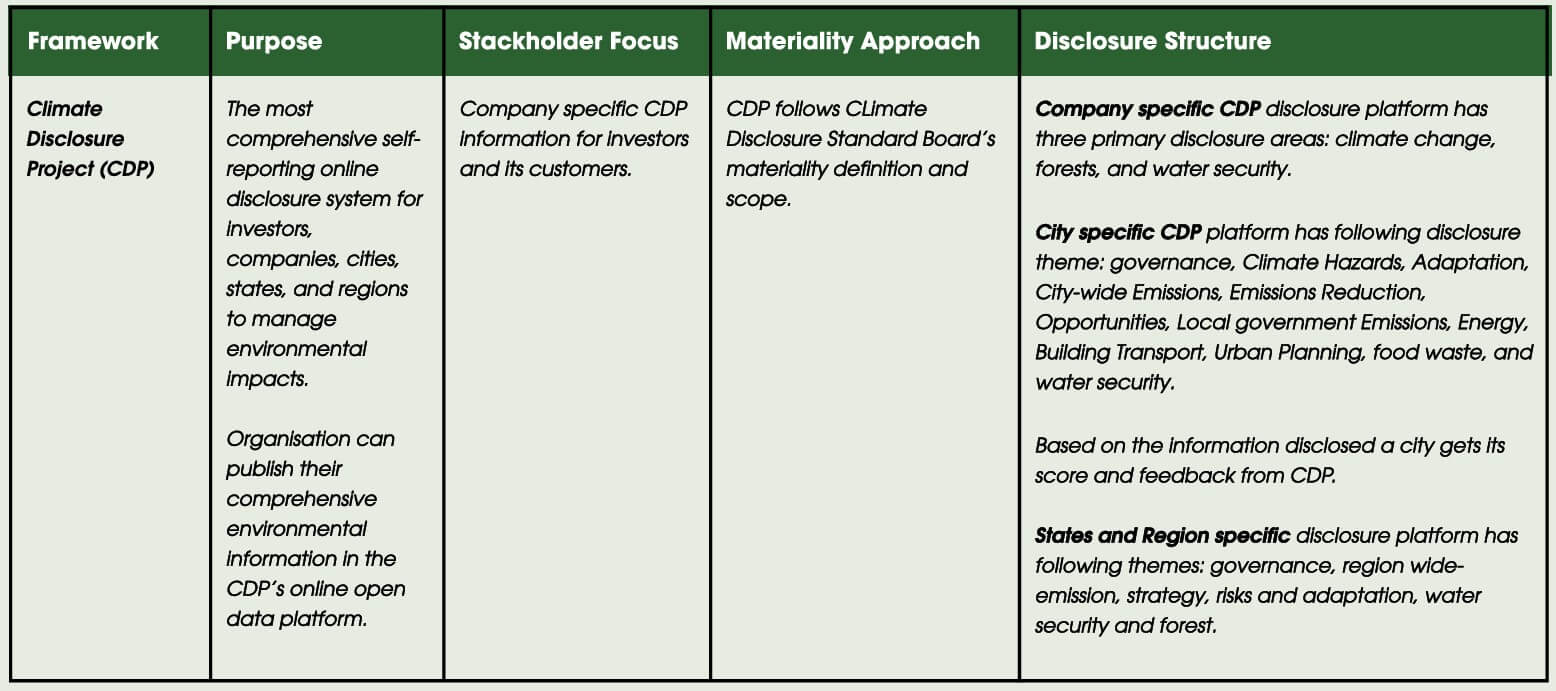

Carbon Disclosure Project (CDP)

In 2000, CDP was established as a not-for-profit organization with the aim of building a sustainable economy and providing a global environmental disclosure system for companies, investors, cities, states, and regions. CDP provides its members an open-access online data portal to disclose their actions on climate, water, forest, and supply chain and their risks, as well as adaptation and mitigation strategies.

The platform focuses on measuring environmental impact for investors, companies, cities, and governments, along with information about how these entities act on their environmental impact. As of 2021, over 14,000 organizations, including 13,000 companies and about 1,100 cities, states, and regions, disclosed their environmental performance data through CDP’s online platform.

Table 5 An overview of the Climate Disclosure Project (CDP)

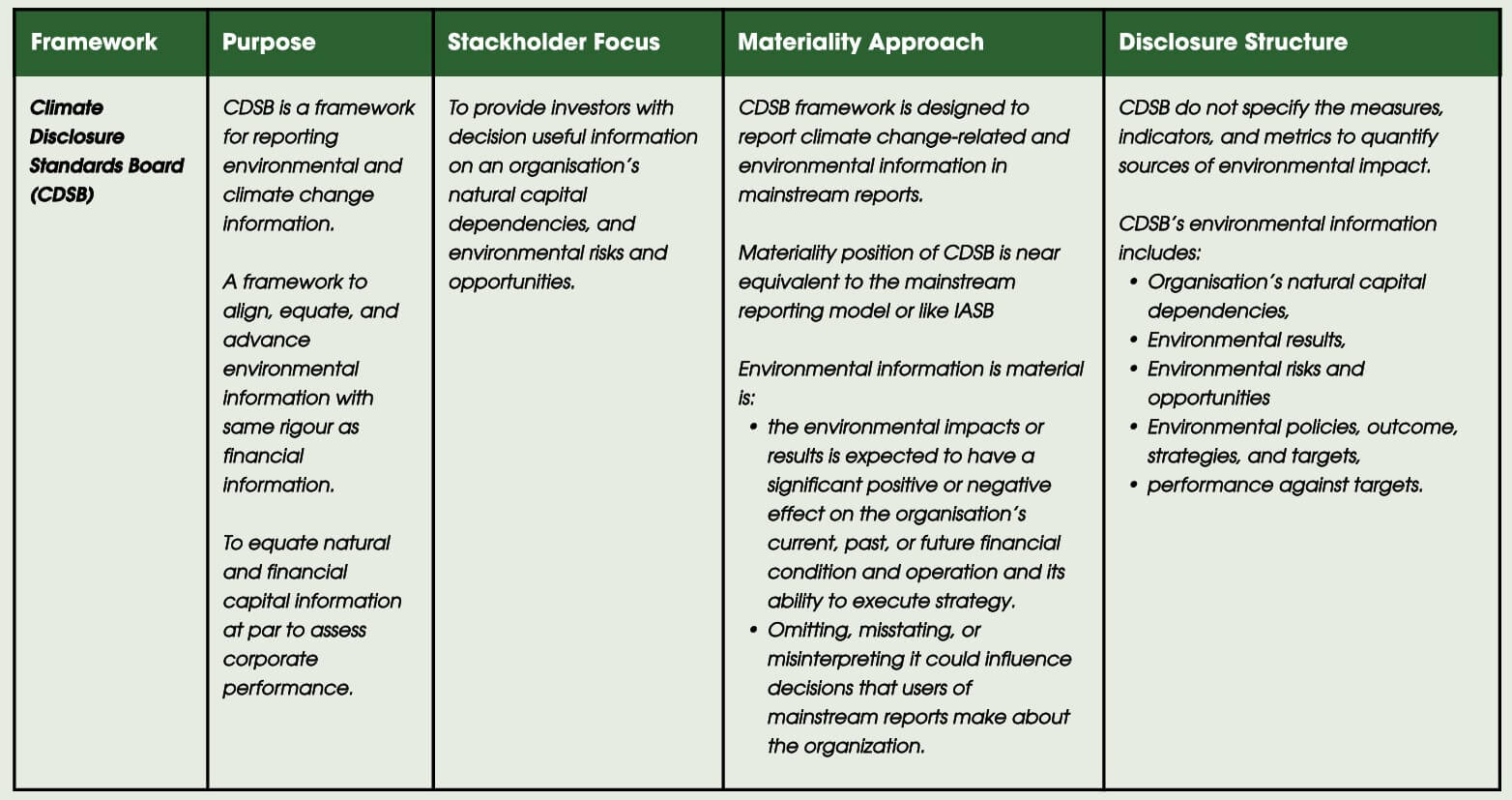

Climate Disclosure Standards Board (CDSB)

The CDSB was formed in 2007 to standardize environmental information reporting. In the CDSB’s standard, environmental information is material if “the environmental impacts or results it describes are, due to their size and nature, expected to have a significant positive or negative effect on the organization’s current, past or future financial condition and operational results and its ability to execute its strategy; or omitting, misstating or misinterpreting it could influence decisions that users of mainstream reports make about the organization.”

The CDSB framework expects an organization to report about its’ natural capital dependencies, environmental results, environmental risks and opportunities, environmental policies, outcomes, strategies and targets, and performance against targets. These aspects are addressed by answering twelve Reporting Environmental Questions (REQs), which are aligned with the recommendations of the Task Force on Climate-related Financial Disclosure (TCFD) on governance, strategy, risk management, metrics, and targets.

The twelve REQs are about governance, management’s environmental policies, strategy, and targets, risks, and opportunities, sources of environmental impacts, performance and comparative management’s environmental policies, strategy, and targets, risks, and opportunities, sources of environmental impacts, performance and comparative analysis, outlook, organisational boundary, reporting policies, reporting period, restatements, conformance, and assurance.

The CDSB’s environmental information disclosure is guided by the following principles: Relevance and materiality, faithful representation, connection with other information, consistency and comparability, clarity and understandability, verifiability, and forward-looking. In relation to environmental risks, CDSB expects an organization to identify its environmental regulatory risks and the physical effects of climate change.

For example, Regulatory risks include GHG emission limits, energy efficiency standards, carbon taxation, process or product standards, and participation in GHG trading schemes, and physical effects of climate change include changing weather patterns, rising sea levels, shifts in species distribution, changes in water availability, changes in temperature, and variations in agricultural yield. In addition to these, there are reputational and litigation risks.

Hence, in the CDSB framework, environmental information provides the scope of data where relevant environmental information is the subset of environmental information identified by management, and material information is the subset of relevant environmental information.

Table 6 An overview of the Climate Disclosure Standard Board (CDSB)

Global trends on the uptake of Sustainability Practices

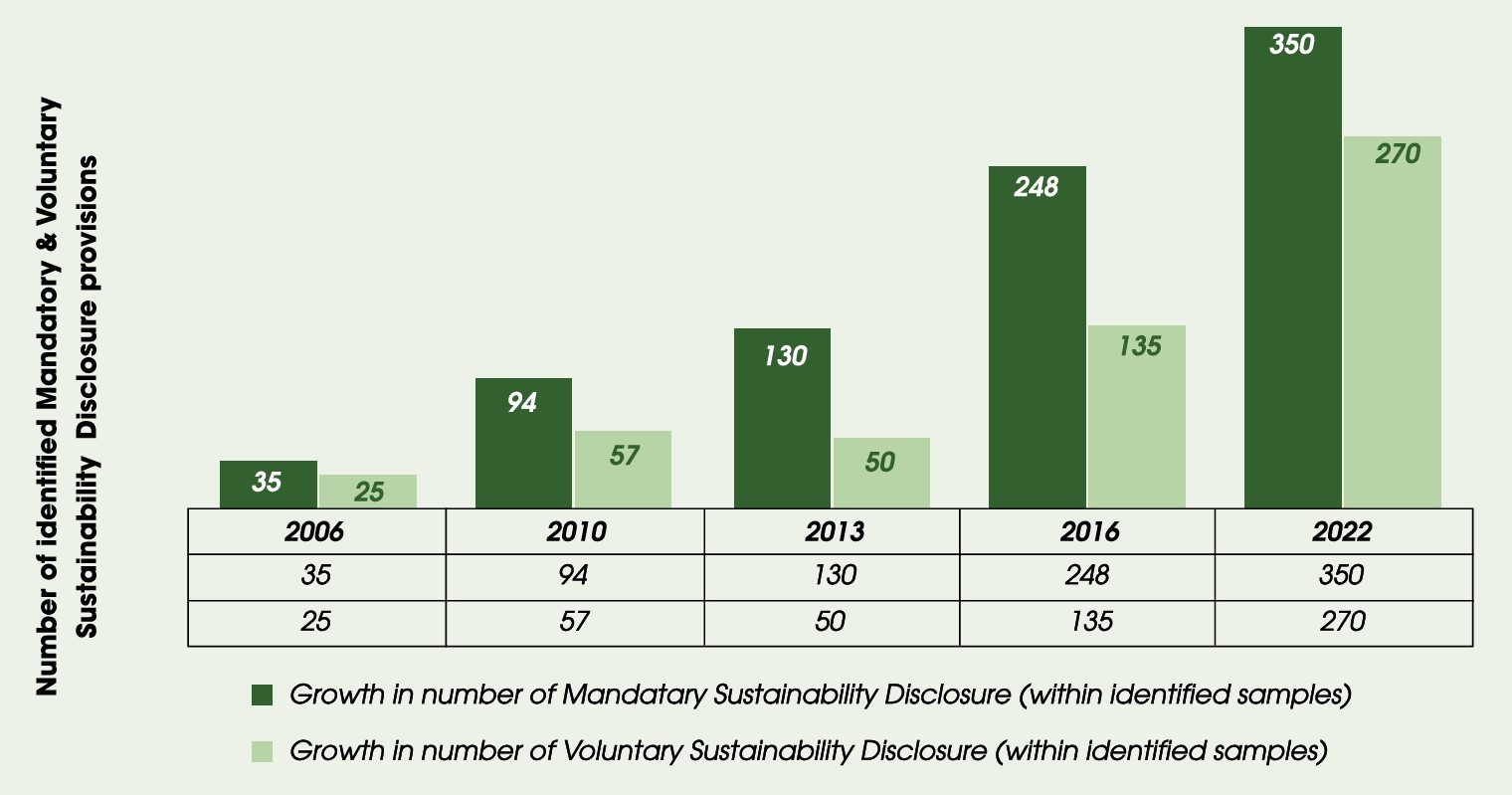

The global trend shows that the sustainability agenda has been mainstreamed over the years. Longitudinal studies such as ‘Carrots & Sticks’ by the GRI and ‘The Time has Come’, a survey by KPMG, confirm this growing global trend. The findings of these reports show that

there has been a steady growth in mandatory disclosure provisions since 2006.

Graph-1 – Growth in the number of Mandatory and voluntary Sustainability Disclosure provisions between 2006 and 2020

The survey can also identify a growing proportion of voluntary sustainability disclosure provisions within the surveyed sample. This trend suggests an increasing sense of urgency among organizations to monitor specific sustainability performance criteria.

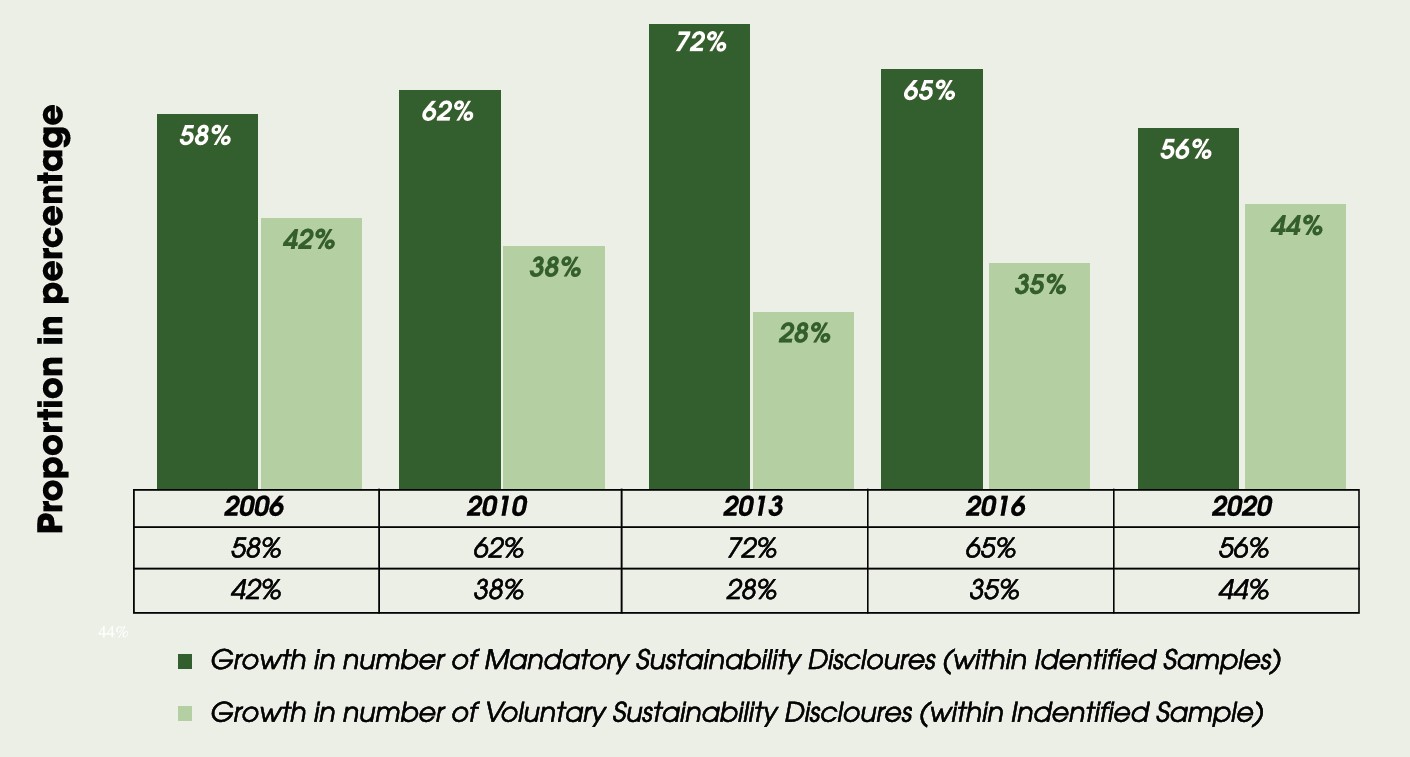

Graph-2: Proportion of Mandatory & Voluntary Sustainability Disclosures (2006-2020)

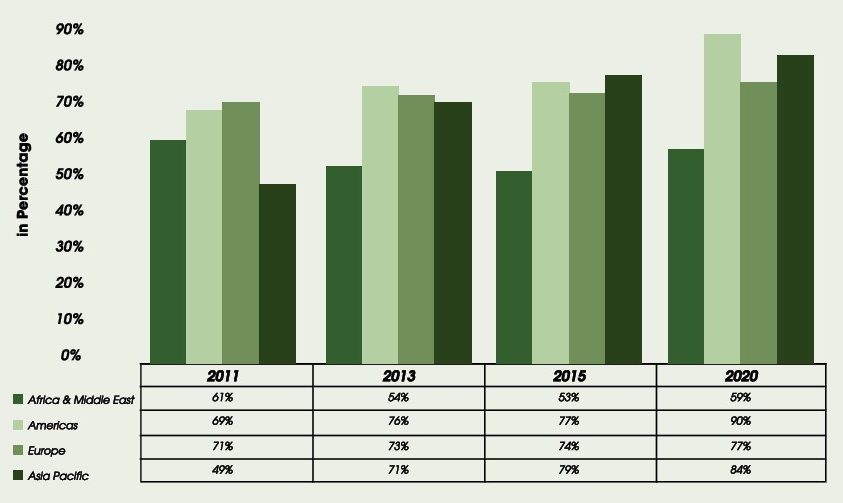

Supportive of the growing trend data, the uptake of sustainability disclosure among companies can also be noticed across regions. Companies in the Americas (including North and South America) report most on sustainability performance, followed by companies in Asia Pacific, Europe, Africa, and the Middle East. Among all regions, the trend of sustainability reporting among Asia-Pacific companies is growing fastest.

More specific country-wise data showed that 90% of top companies (by revenue) in Japan, Mexico, Malaysia, India, the USA, Sweden, Spain, France, South Africa, the UK, Taiwan, Australia, Canada, and Germany report on their sustainability performance. Sector data highlight that, except in the retail sector, almost 70% of the top 100 companies in all sectors report on their sustainability performance.

Graph-3 Trend of Sustainability Reporting among Top 100 Companies by Revenue (Regional trend between 2011 to 2020)

Table 7 Countries where companies disclose sustainability information.

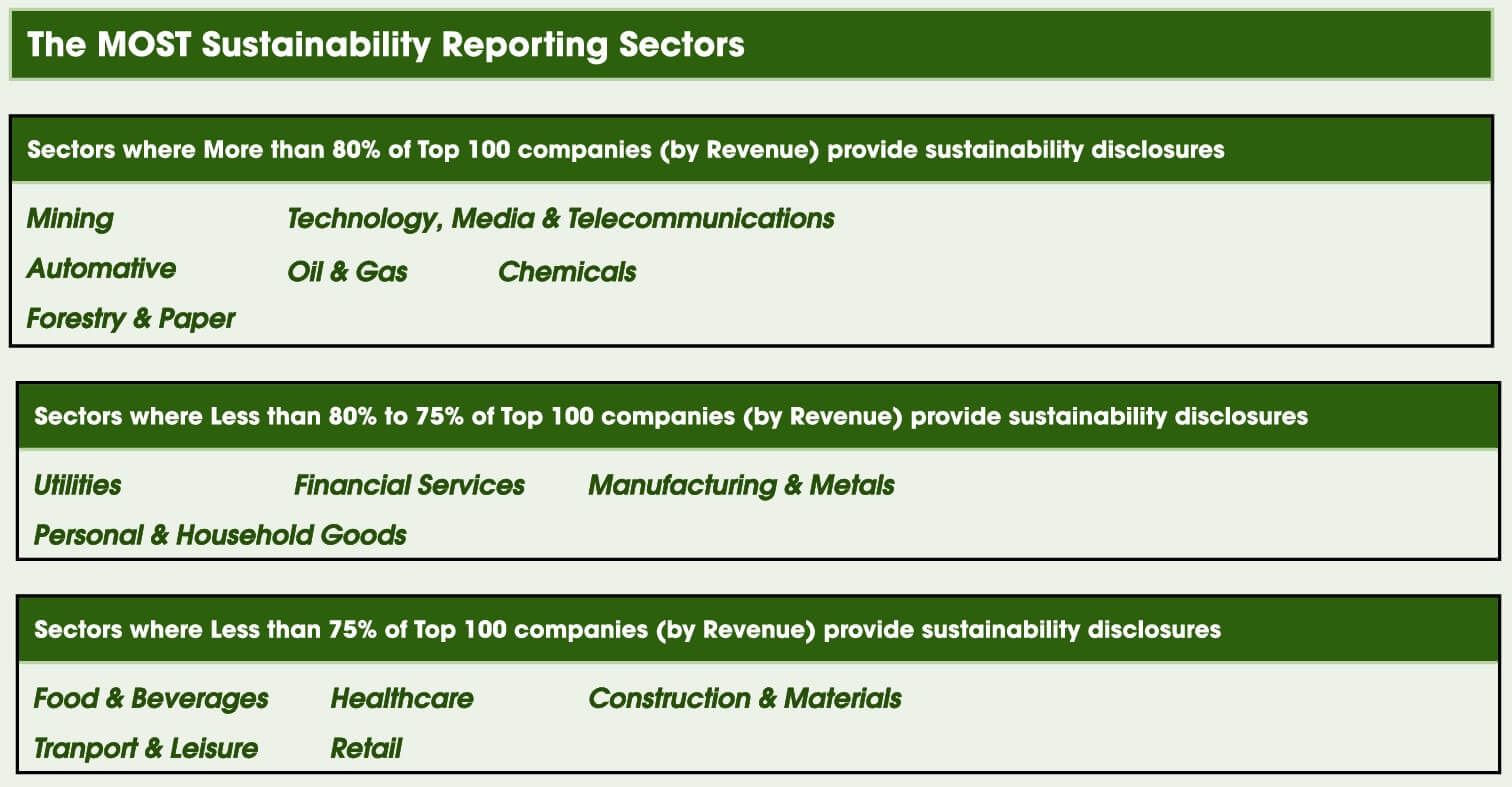

Sector trends showed that reporting rates of companies in sectors such as mining, technology, media and telecommunications, automotive, oil and gas, chemicals, forestry, and paper exceed 80%.

Table 8 The MOST Sustainability Reporting Sectors

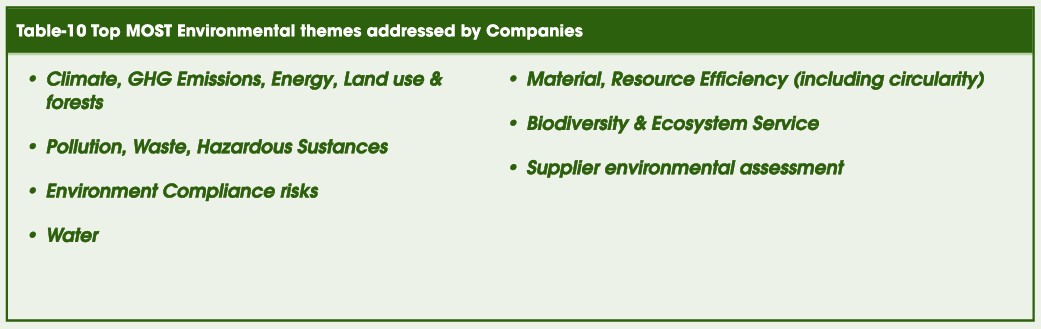

Sustainability is a holistic concept that encompasses environmental, social, economic, and governance topics. Any improvement in an organization’s sustainability performance depends on the extent and depth of coverage of environmental, social, governance, and economic topics.

Among all environmental sustainability topics: a) climate, GHG emissions, energy, land use & forests; b) pollution, waste, hazardous substances; and c) environmental compliance risks are the TOPMOST-reported topics.

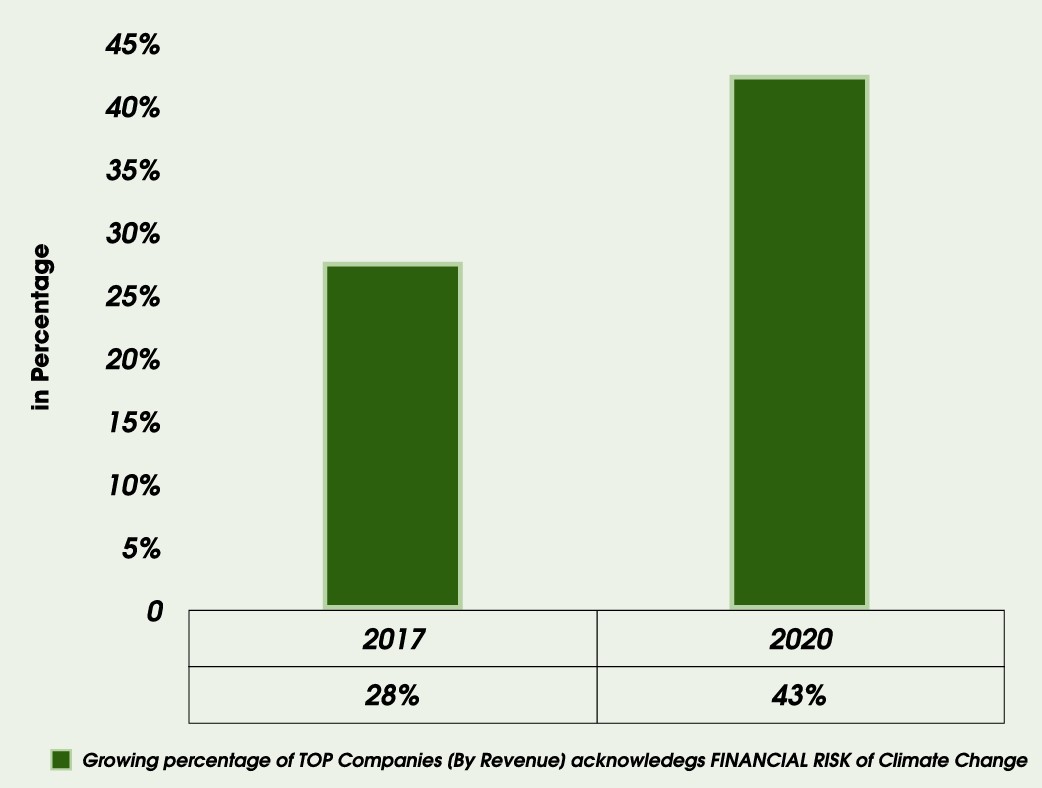

Data suggest that all significant companies across the globe have started acknowledging the financial risk of climate change. Top companies in Taiwan, France, the UK, the Netherlands, and South Africa acknowledge the most significant risk of climate change.

Graph-4 Percentage of companies acknowledging the FINANCIAL RISK of Climate Change

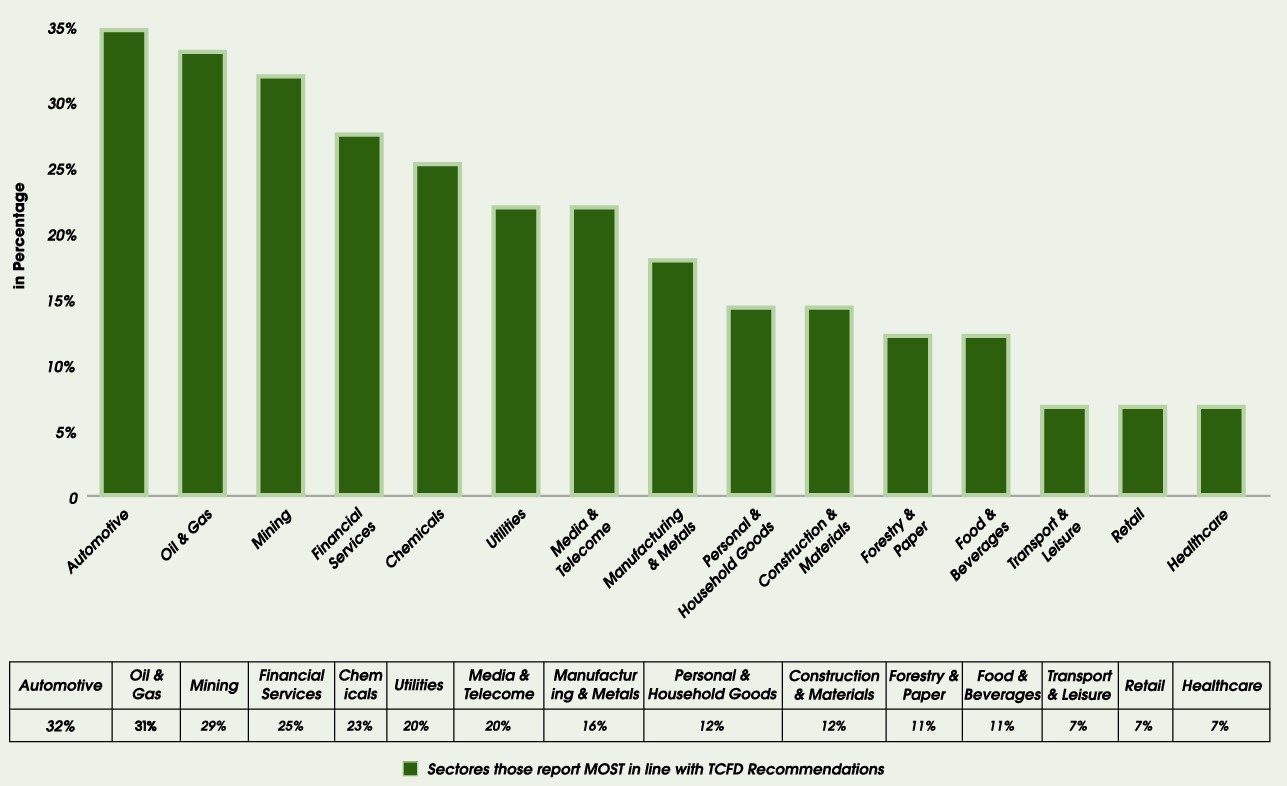

As the risk perception of climate change increases, companies across sectors are also aligning their corporate risk management strategies with the Task Force of Climate-related Financial Disclosures (TCFD)recommendations. In this respect, automotive, oil gas, mining, and financial services companies are ahead of all other sectors.

Graph-5 Sectors those aligned MOST with TCFD Recommendations

In addition to climate change risks, the world faces similar risks from biodiversity loss. The fifth UN Global Biodiversity Outlook report highlighted this fact and emphasized the interlinkage across climate change, unrecoverable loss of biodiversity, and long-term food insecurity.

Similarly, a Swiss Re Institute report mentioned that 55% of global GDP depends on high-functioning biodiversity and ecosystems. Biodiversity is a fundamental component of the long-term survival of businesses; therefore, companies must disclose the impact of their operations on biodiversity and the risks of biodiversity loss on their business.

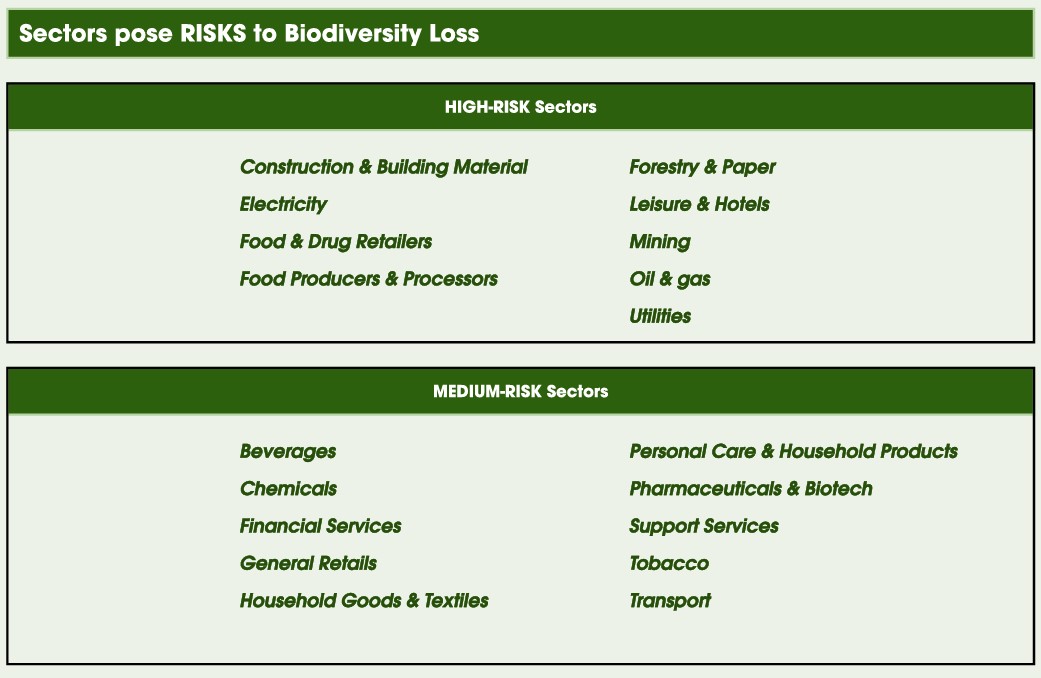

As per KPMG’s survey, sectors such as construction and building materials, electricity, food and drug retailers, food producers and processors, forestry and paper, leisure and hotels, mining, oil and gas, and utilities pose a high risk of biodiversity loss. In addition, sectors such as beverages, chemicals, financial services, general retail, household goods and textiles, personal care and household products, pharmaceuticals and biotech, support services, tobacco, and transport pose a medium risk to biodiversity.

Table-9 Sectors pose RISKS to Biodiversity loss.

Although the Global Risks Report 2021 categorized ‘Biodiversity Loss’ as a long-term or existential risk, the reality is that disclosure of ‘Biodiversity & Ecosystem Services’ has remained low and generic across many companies. Much of our economic prosperity depends on the quality of biodiversity. Many companies’ profitability depends on the quality of biodiversity. So, loss of biodiversity poses RISK to their business.

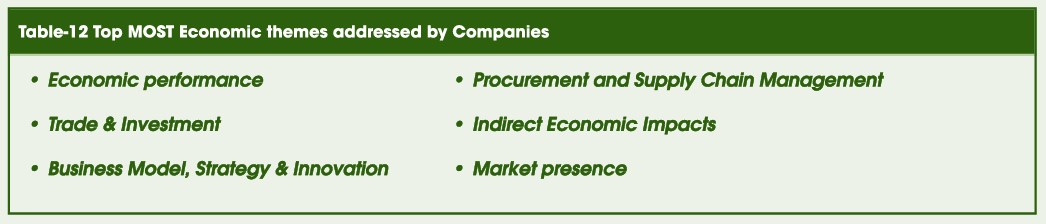

Under the social sustainability topics, a) human rights, b) employment conditions, policies, and practices, and c) social impact and value creation are the TOP THREE reported topics among surveyed companies. Under the economic sustainability theme, a) economic performance, b) trade and investment, and c) business model, strategy, and innovation are the most reported topics.

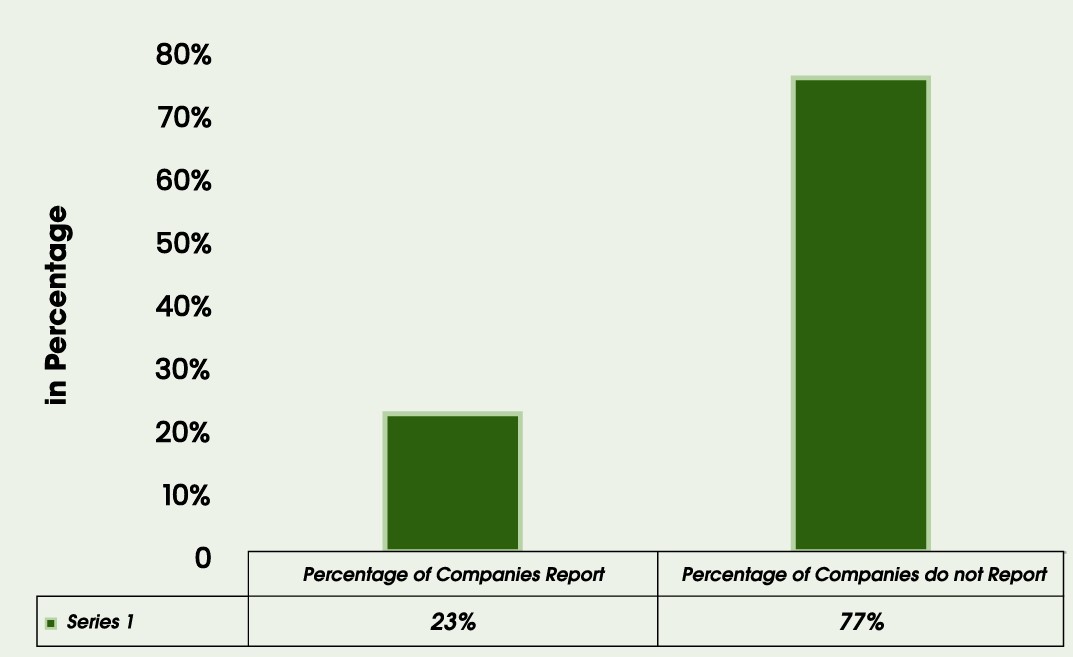

Graph-6 Percentage of Top “At Risk” Companies reporting on the risk of biodiversity loss to their business operation.

As per the survey, 77% of the top ‘At Risk’ companies do not report on the risk of biodiversity loss to their business.

Only 23% of companies report the risk of biodiversity loss to their business. Out of this reporting percentage, companies from mining, forestry and paper, food and beverages, oil and gas, and personal and household goods report the most on biodiversity loss. Meanwhile, under the governance theme, a) accountability, anti-corruption, and anti-competitive Behaviour; b) structure and leadership; and c) ethics and integrity are the most reported themes. However, a comprehensive analysis of the disclosures suggests that most disclosures of companies are relatively generic rather than providing an explicit narrative.

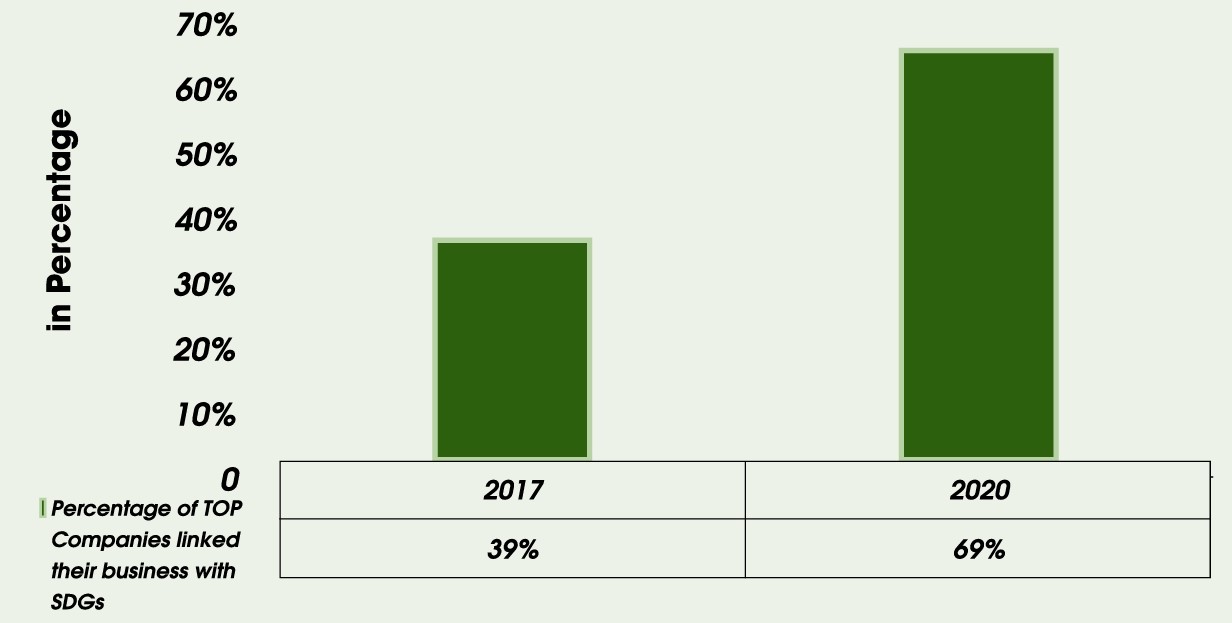

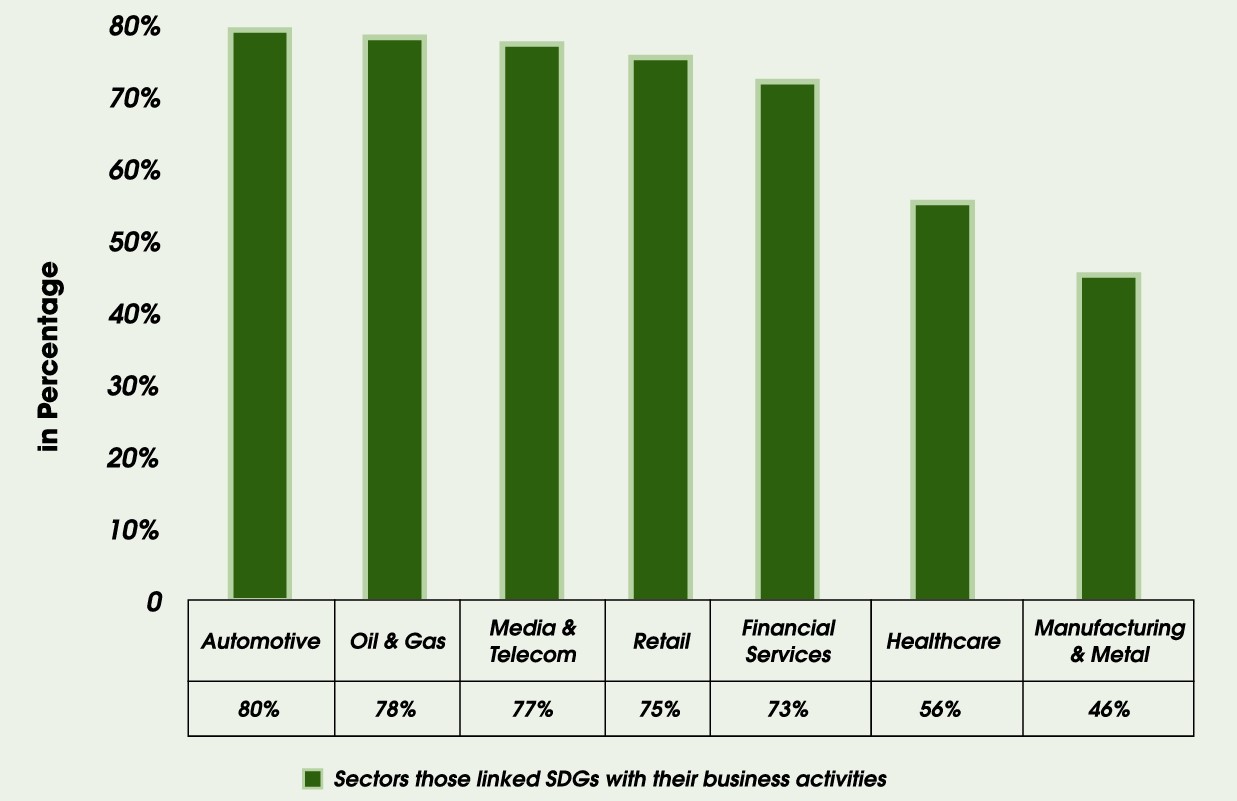

In addition to organisational-specific sustainability frameworks such as GRI, IIRC, SASB, CDP, and CDSB, since 2015, the Sustainable Development Goals (SDGs) have acted as a macro-level road map for a sustainable world. About 69% of companies across sectors align their business with SDGs, and out of all sectors, companies from the automobile, oil & gas, media, and telecom sectors aligned their businesses MOST closely with the SDGs.

Graph-7 Percentage of Top Companies Aligned with Sustainable Development Goals

Graph-8 Sectors Aligned with Sustainable Development Goals

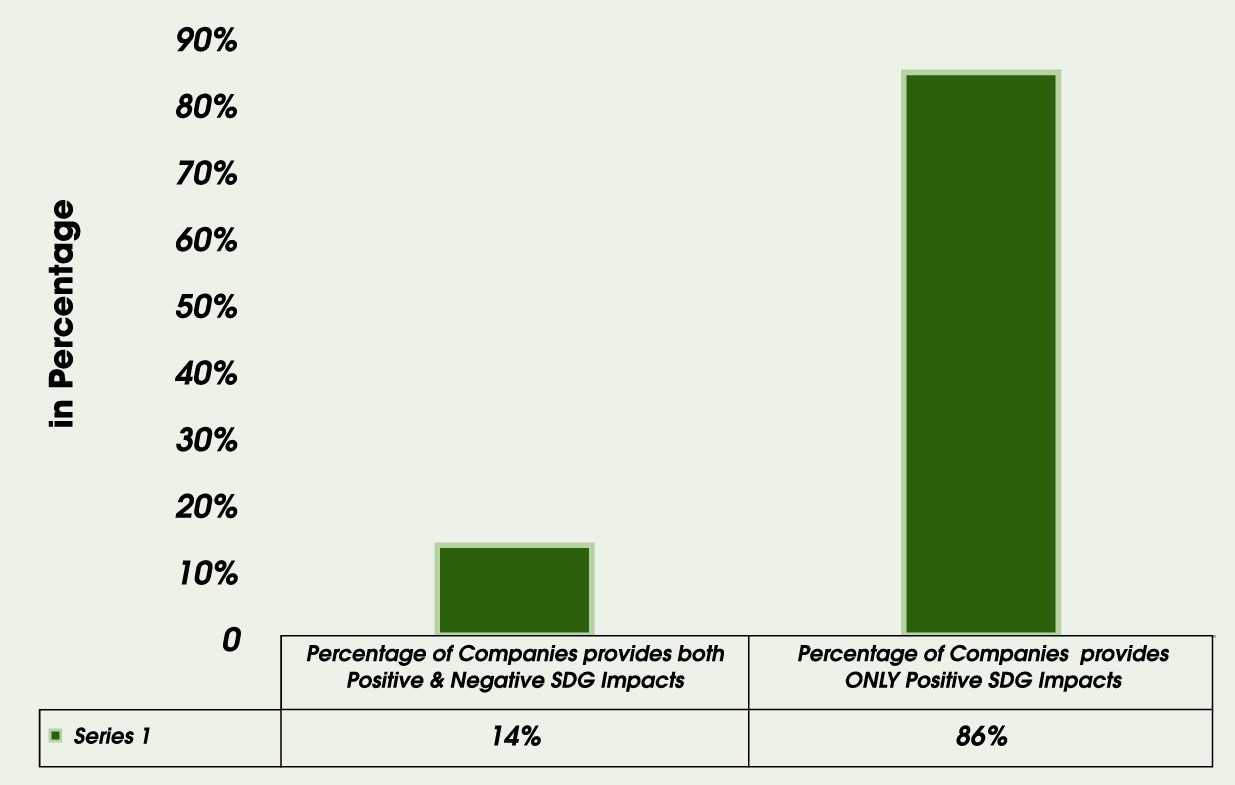

However, aligning a company’s business with SDGs does not mean they provide a balanced view of their contribution to SDGs. The study suggests that only 14% of all surveyed companies report on the positive and negative impacts of their operations.

Graph-9 Percentage of Top Companies Providing Balanced Impact Reports on Sustainable Development Goals.

Conclusion

Non-financial voluntary reporting frameworks or sustainability reporting frameworks have been in existence for the last 22 years, starting with GRI as one of the pioneers, followed by CDP, IIRC, SASB, and CDSB.

We can broadly categorize GRI, IR, SASB, CDP, and CDSB standards and frameworks into two groups:

a) multi-stakeholder focus as in the case of GRI;

b) investor and capital provider focus as in the case of IR, SASB, CDP, and CDSB.

Furthermore, distinctions can also be drawn based on the materiality perspective. In the cases of IR, SASB, CDP, and CDSB, the materiality approach of a sustainability topic is considered through the prism of financial information.

Conversely, in the case of GRI, the materiality approach of a sustainability topic is wider than financial material in formation. Instead, it advocates that material sustainability information should not be deprioritized based on not being recognized as financially material by the organization.

The trend of considering Sustainability through the prism of financial and material information has further positive direct consequences.

Firstly, it will quantify non-financial sustainability data and improve its usefulness as investment-grade information. Secondly, it will facilitate the flow of capital toward the green economy and will advance the emerging sustainable finance domain.

However, focusing on the financial materiality of sustainability information alone may lead to a sub-optimal outcome in the long term. It may defeat the merits of early normative arguments for sustainability accounting and reporting over traditional financial accounting.

Hence, the literature argues that the financial market should embrace the inherent non-financial nature of ESG data. The pressure to incorporate calculability into ESG data may make many ESG issues invisible.

Because of the growing divergence within various sustainability frameworks and standards, there is a global trend towards convergence of sustainability or ESG reporting frameworks and standards. We have seen the formation of the Value Reporting Foundation after the merger of the International Integrated Reporting Committee (IIRC) and the Sustainability Accounting Standard Board (SASB). The fundamental conceptual models of IIRC and SASB continued to exist.

In addition, an international collaboration is underway to consolidate Sustainability or the ESG landscape under one comprehensive international sustainability standard. Hence, in 2021, the International Financial Reporting Standards (IFRS) Foundation established the International Sustainability Standards Board (ISSB). The project is backed by the Financial Stability Board, the International Organisation of Securities Commissions, regulators, corporations, institutional investors, and other stakeholders.

Currently, the Technical Readiness Working Group (TRWG) has been set up to enable the ISSB to draft a new international sustainability standard based on existing standards and frameworks, including the Climate Disclosure Standards Board, the Task Force for Climate-related Financial Disclosures (TCFD), the Value Reporting Foun nation’s Integrated Reporting Framework and SASB Standards, and the World Economic Forum’s Stakeholder Capitalism Metrics.

The ISSB proposed to provide material, thematic, and industry-focused sustainability information relevant to investors’ decision-making. The materiality approach of ISSB’s proposed standards will focus on identifying “…sustainability matters that are reasonably possible to affect enterprises’ value creation, preservation, or erosion over the short, medium, and long term which therefore would impact investors’ investment decisions…”.

Finally, the global trend in Sustainability or ESG disclosures suggests that there has been considerable uptake of sustainability practices among companies worldwide, from around a paltry 12% in the early 90s to 80 % in 2020. The Percentage is even higher, up to 90 percent, among the world’s largest companies. GRI has remained the dominant ESG reporting standard globally over peers such as IR and SASB.

The reason may be that GRI is the pioneer in this landscape and hence garners much more universal acceptance and legitimacy because of its stakeholder focus rather than the investor-only focus. However, there has been a growth in the adoption of IR in France, Japan, India, and Malaysia over recent years. Another significant trend is the growth in providing third-party assurance of sustainability information by reporting entities. Even though ‘reporting on risk from biodiversity losses remained low, climate change risk caught the imagination of the corporate world.

With SDGs, the trend suggests that corporate reporting on SDGs needs to be more balanced and connected to business goals. However, the silver lining is that most companies are connecting their activities with the seventeen global Sustainable Development Goals set by the United Nations.

Reference: